Nobel economics laureate Paul Krugman got upset on a recent plane flight when he saw Ron Paul on NewsMax TV on the jet’s telescreen. Krugman wondered, “Who knew there was such a thing? Is it there to serve people who find Fox News too liberal?”

Actually, Newsmax, like Fox News, is neoconservative – that is, like the NY Times, it’s liberal interventionist on foreign policy, yet unlike the Times, skeptical of making domestic government larger.

But here’s what got the Princeton economist’s Keynesian dander up:

“[A]nd as best I could tell from the visual context (the sound was blessedly off), the elder Paul was lecturing us about monetary policy.

“This sort of thing is obviously an important part of the reason we’re living in an age of derp. Events and data may have made nonsense of claims that the Fed’s policies would inevitably produce runaway inflation, and made those insisting on such claims look like fools; but there’s a large audience of people who, pulled in by affinity fraud, live in a bubble where they never hear about such evidence.”

The NY Times paywall wouldn’t let me click through to find out what “derp” means. But New York magazine explains:

“Roughly defined, derp is an onomatopoeic exclamation uttered in response to a boneheaded action of some kind. Its adjective form, derpy, describes someone who is prone to acting like an idiot. Derpitude is the persistent state of being derpy. Over the past few years, the political class on Twitter has appropriated the term as a pejorative to point out an obtuse or stupid argument.”

As if that were something new in human history.

But Ron Paul and many others warning of inflation, such as Peter Schiff, never have said we certainly would have “runaway inflation,” as in Weimar Germany in the early 1920s or recently in Zimbabwe, only that the Fed was inflating the currency, which was damaging the economy.

And Ron Paul was right in warning as early as 2003 the Fed’s policies, as well as U.S. government housing planning foolishness, would turn the housing bubble into an economic crash

Krugman lives in a rarefied world of NY Times editors and Princeton profs, and is wealthy from his Nobel prize, columns, books and other endeavors, so he doesn’t know what it’s like down here in the inflationary trenches. But here’s what’s happened to me since Fed vozhd Alan Greenspan panicked after 9/11/2001 and began the latest inflationary cycle, pushing the value of the dollar from an average of $350 an ounce from 1981 to 2001, to $1,249 today – a 256 percent increase.

The price of a gallon of gas in Southern California has soared from an average of 99 cents a gallon in 2001 to $3.50 today – a 262 percent increase.

The price of a pound of Target-brand bacon has soared from $1.39 in 2009 to $4.99 today – a 259 percent increase (per my personal records).

My rent has doubled since 2001.

The cost of a small, middle-class (formerly) house in my area of Huntington Beach has risen from $169,000 on average to $1 million today – a 515 percent increase; albeit much of that comes from California’s Soviet-level restrictions on housing construction.

Meanwhile, my salary is a paltry 10 percent higher than in 2001.

It’s true the government’s official Consumer Price Index Inflation Calculator at the Bureau of Labor Statistics clocks inflation from 2001 to 2014 at only 34 percent. But that’s because Bill Clinton rigged the formulas before his 1996 re-election campaign. The numbers also were fudged to cut Social Security cost-of-living adjustments and so delay the system’s inevitable bankruptcy.

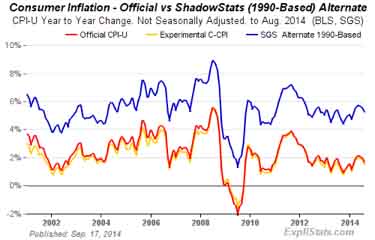

According to Shadowstats, using the pre-Clinton inflation formulas yields annual inflation well above 5 percent in recent years, not the 2 percent or so from the official numbers.

Age of derp indeed.

Leave a Reply